Trademark Infringement Alert: How to Fortify Your Brand’s Defenses

Safeguarding your brand is crucial in today’s dynamic business world. Your brand is more than just a name or logo, it’s a representation of your

Safeguarding your brand is crucial in today’s dynamic business world. Your brand is more than just a name or logo, it’s a representation of your

In a significant legal development, the High Court has recently granted relief to Zydus Glucon-D, a leading pharmaceutical company, by barring Cipla from using the

In today’s competitive business world, trademarks are crucial to establishing brand identity and protecting intellectual property. However, it’s essential to regularly monitor and check trademark

In the era of Digitization, businesses are growing rapidly through the internet and have crossed all boundaries, as have their identities and competitions. For a

This blog focuses on the difference between a registered trademark and an unregistered trademark in India. But before moving forward to this topic we need

A public notice issued by The Ministry of Commerce & Industries dated 6th February 2023, through this notice the department is likely to treat all

Trademark Registration for Online Sellers Trademark Registration is essential for any business that wants to succeed on online platforms such as Amazon. It safeguards your

We are living in the 21st century an era of digitation we are surrounded by the digital world, all thanks to the internet. Internet users

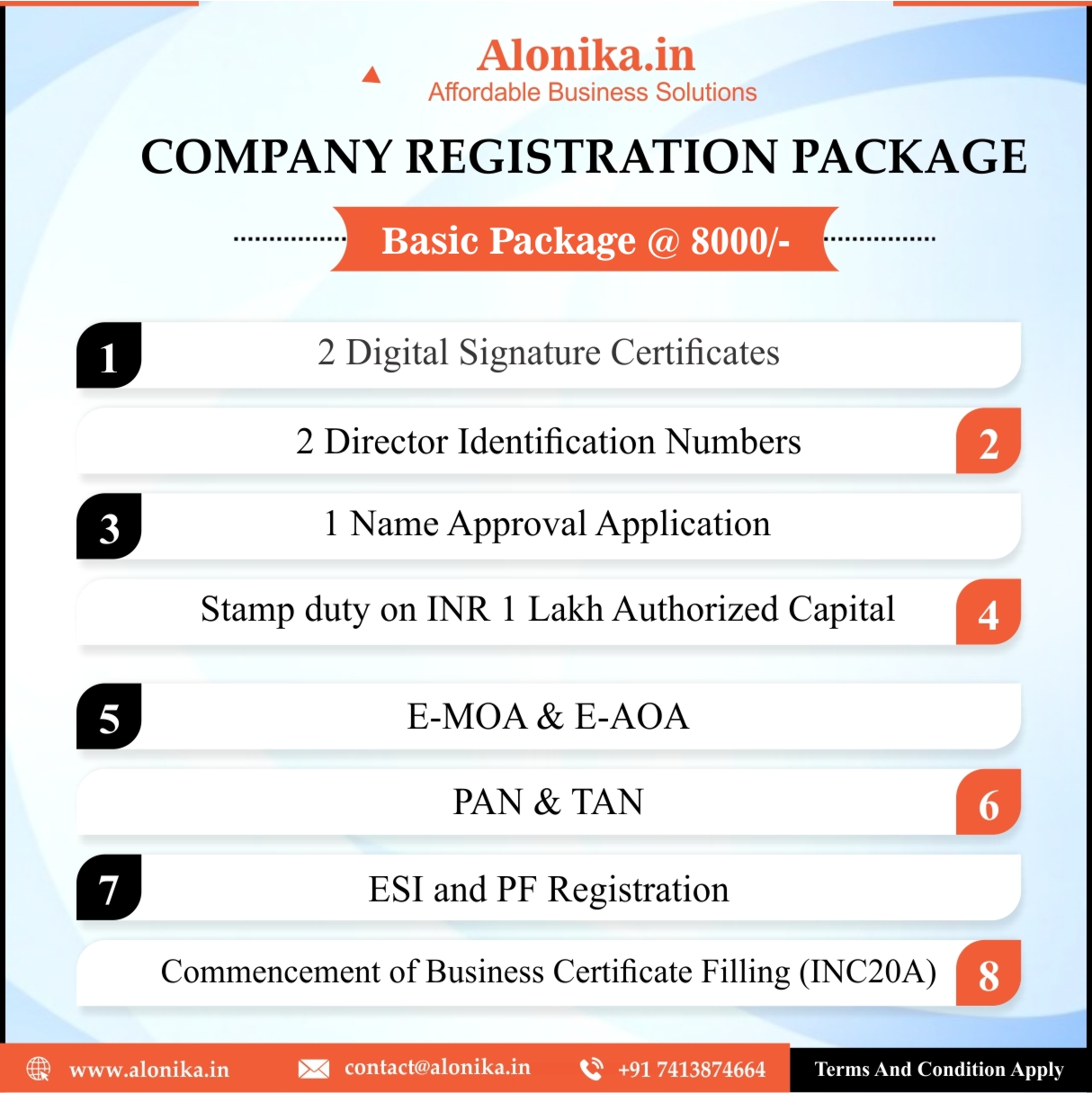

To register the Pvt. Ltd company no minimum capital is required.

Getting DSC Certificate: This is a mandatory step to start a private limited company. DSC means Digital Signature Certificate for the directors and shareholders involved in the company. The main objective of the DSC is to sign all the e-forms.

Getting DIN number: DIN stands for Director Identification Number. Every company director needs to have a DIN to be appointed as a director in the company.

Approval of company name: The next step is the approval of the company’s name. The Applicant has to choose a unique name for the approval of the company’s name. Your company’s name should not be similar to any other company’s name.

Fill out the New SPICe + forms: SPICe is the abbreviation for Simplified Performa for Incorporating Company Electronically. The Government of India, Ministry of Corporate Affairs introduced the new SPICe+ form on 6th Feb 2020 in the Gazette of India. SPICe+ is an integrated Web form offering 10 services by 3 Central Govt Ministries & Departments. (Ministry of Corporate Affairs, Ministry of Labour & Department of Revenue in the Ministry of Finance) and One State Government (Maharashtra), thereby saving as many procedures, time, and costs for Starting a Business in India. This Single form provides many services:

Getting the Incorporation Certificate: After completing the SPICe+ form. The Registrar will check all the documents and issue the incorporation certificate and will allow the CIN number within 5- 7 working days. Moreover, the Applicant will get the incorporation certificate on E-Mail ID.

Opening of Bank Account: After the company gets Incorporated, a Bank Account will be opened in the bank the applicants decide at the time of filing of SPICE+ form. Bank details will be sent on mobile no by the MCA dept and the same will be operative once that bank representative completes all the KYC of the Directors.

Safeguarding your brand is crucial in today’s dynamic business world. Your brand is more than just a name or logo, it’s a representation of your

In a significant legal development, the High Court has recently granted relief to Zydus Glucon-D, a leading pharmaceutical company, by barring Cipla from using the

In today’s competitive business world, trademarks are crucial to establishing brand identity and protecting intellectual property. However, it’s essential to regularly monitor and check trademark

In the era of Digitization, businesses are growing rapidly through the internet and have crossed all boundaries, as have their identities and competitions. For a

This blog focuses on the difference between a registered trademark and an unregistered trademark in India. But before moving forward to this topic we need

A public notice issued by The Ministry of Commerce & Industries dated 6th February 2023, through this notice the department is likely to treat all

Trademark Registration for Online Sellers Trademark Registration is essential for any business that wants to succeed on online platforms such as Amazon. It safeguards your

We are living in the 21st century an era of digitation we are surrounded by the digital world, all thanks to the internet. Internet users